#2 Diversification

Diversification is a key component of a smart investment strategy, and real estate can be a great way to diversify your portfolio. By investing in real estate, you can spread your investment dollars across multiple properties, which can help to reduce risk and increase potential returns.

One of the biggest benefits of diversifying your investments through real estate is the ability to spread risk across multiple properties. By investing in multiple properties, you can reduce the impact of any one property’s poor performance on your overall portfolio. Additionally, owning multiple properties in different markets can also help to insulate your investments from the effects of a local market downturn.

Another benefit of diversifying your investments through real estate is the ability to earn income from multiple sources. By renting out multiple properties, you can create a steady stream of passive income, which can help to offset any potential losses from other investments. Additionally, owning multiple properties in different markets can also help to diversify your income stream, as different markets may perform differently at different times.

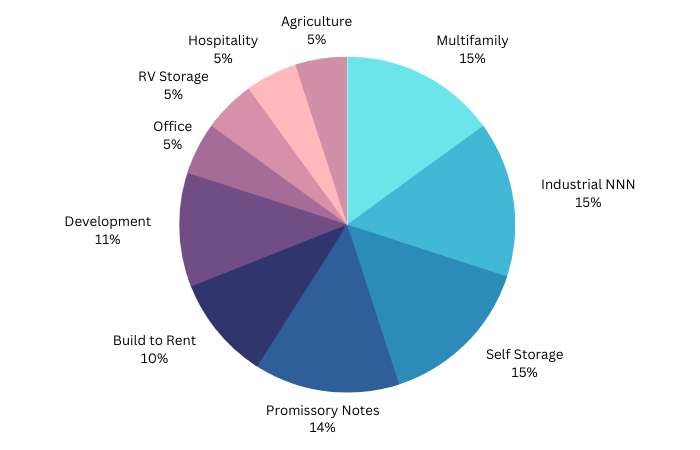

Real estate also offers diversification in terms of the type of property you invest in. You can choose to invest in residential, commercial, or industrial properties, or a mix of all. This can help you to spread your risk even further and cater to different types of renters.

Real estate investment trusts (REITs) is another way to invest in real estate and diversify your portfolio. REITs are companies that own and operate income-producing real estate and are traded on stock exchanges. By investing in REITs, you can gain exposure to a diversified portfolio of properties without the headaches of being a landlord.

In conclusion, diversification is a key component of a smart investment strategy, and real estate can be a great way to diversify your portfolio. By investing in multiple properties, different types of properties and REITs, you can spread your risk and increase your potential returns. A diversified real estate portfolio can be a great way to secure your financial future.

Recent Comments